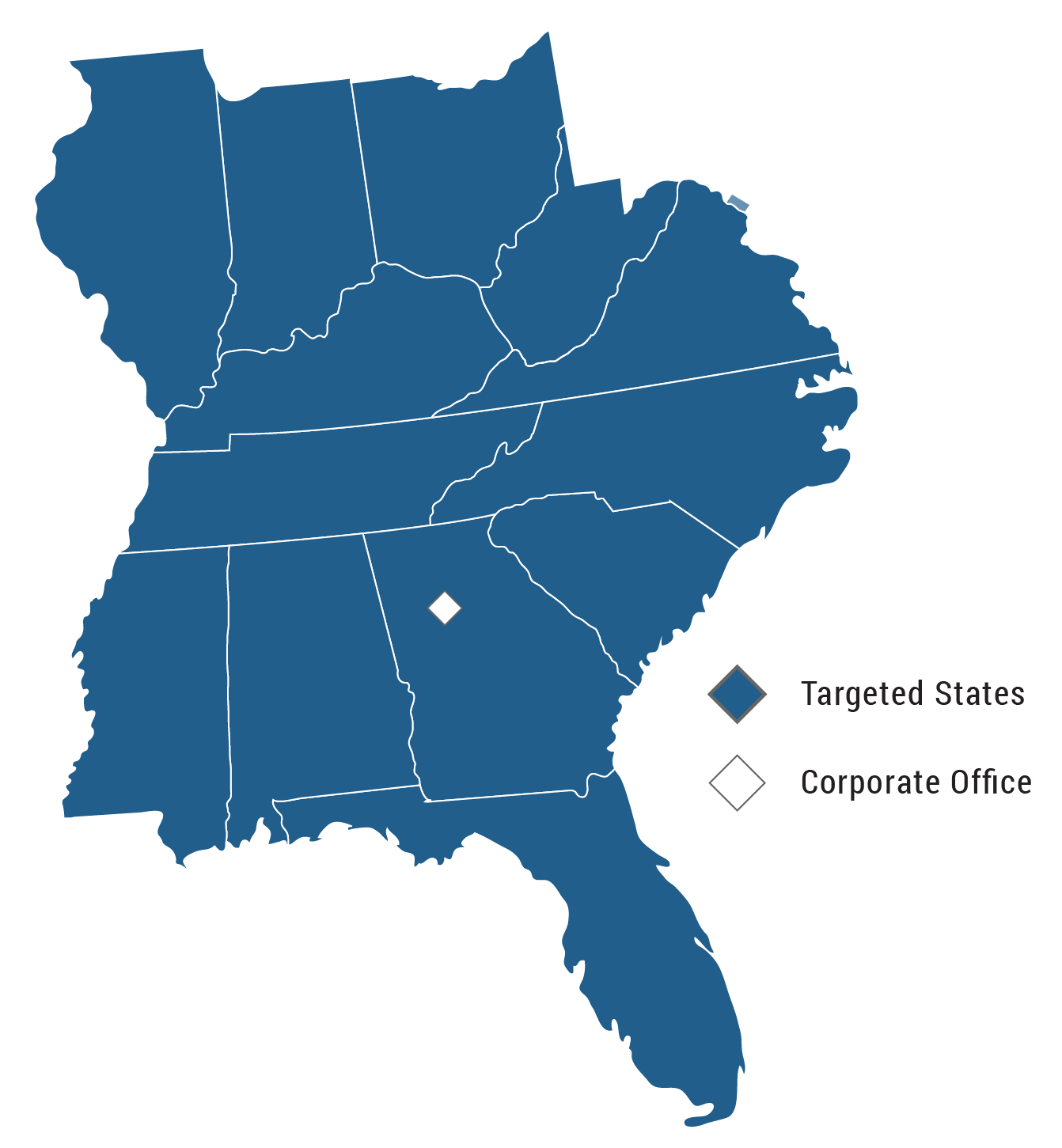

We are actively acquiring shopping centers in the Southeast and Midwest. We seek properties with fundamentally-sound characteristics that have been negatively impacted by situational circumstances that can be overcome. Using our in-house, diverse team of professionals, our goal is to improve the physical, tenancy, financial, operational or management attributes of such properties to create meaningful value for our investors.